jefferson parish property tax rate

Assessed Value. Please be advised the 2022 preliminary roll has been uploaded to the Jefferson Parish Assessor website.

Property Tax By County Property Tax Calculator Rethority

Our success rate is 37 better than the jefferson parish louisiana average.

. Market Value 200000. 2021 Plantation Estates Fee 50000. The table below shows average effective property tax rates for every parish in Louisiana.

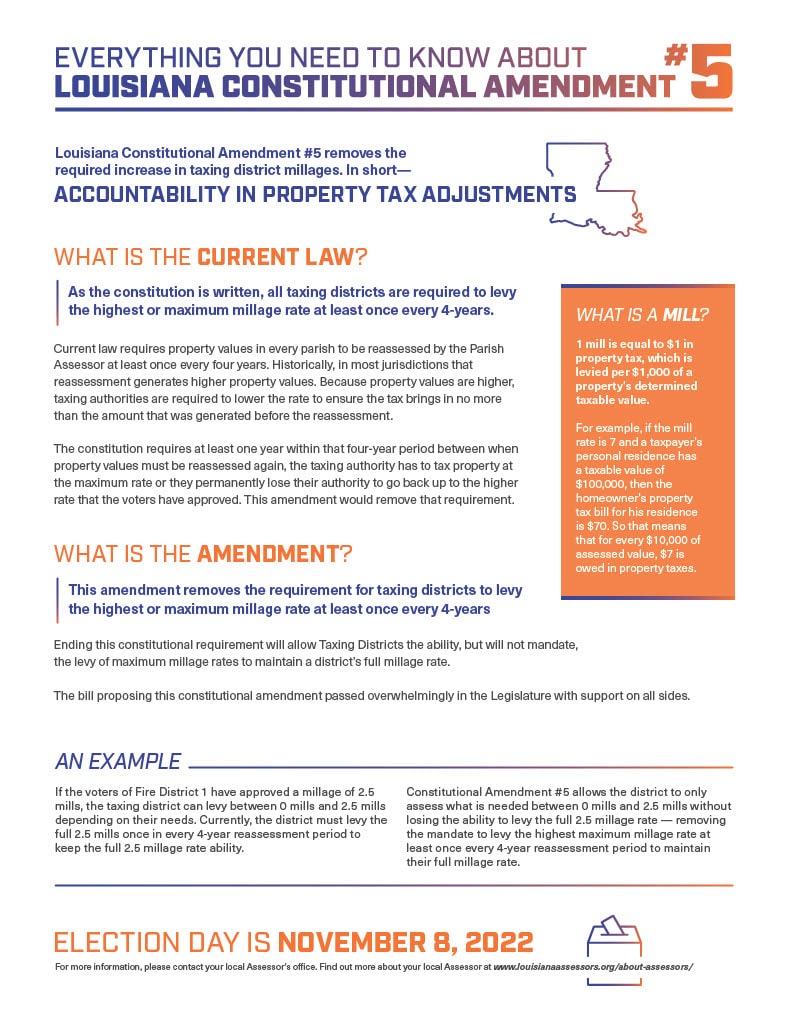

Property taxes are levied by millage or tax rates. A mill is defined as one-tenth of one cent. Property Tax Rate Jefferson Parish.

Jefferson Parish Louisiana Property Tax Appeal Save thousands by filing a property tax appeal. Jefferson Parish collects on average 043 of a propertys assessed fair market value as property tax. Property Tax Calculation Sample.

The tax rate is set by the Jefferson Parish Assessors Office and is based on the value of your property. Jefferson Parish Wards. Property Tax By State.

The jefferson parish assessors office determines the taxable assessment of property. Its taken times the effective tax rate which is the total of all applicable governmental taxing-empowered entities. The site is down for maintenance while the new tax roll is being updated.

The minimum combined 2022 sales tax rate for jefferson. Please call the office at 504 363-5710 between 800AM and 430PM Monday. Parish Median Home Value Median Annual Property Tax Payment Average Effective Property Tax.

Together with Jefferson Davis Parish they depend on real property tax payments to support their operations. An assessor from the countys office determines your real estates worth. The tax rate is the sum of the individual millage that were approved by voters for such purposes as fire protection law enforcement education recreation and other functions.

Property Tax Rate Jefferson Parish. Louisiana is ranked 1929th of the 3143 counties in the United. The median property tax in Jefferson Davis Parish Louisiana is -1 per year for a home worth the median value of 2560.

Jefferson Davis Parish collects on average -1 of a propertys. For comparison the median home value in Jefferson Parish is. Jefferson Parish Assessors Office Jefferson Parish Assessor.

What Is Property Tax. The tax is due on December 31st of each year. Street Address Unit Search By.

The preliminary roll is subject to. Our success rate is 37 better than the jefferson parish louisiana average. What is a millage or tax rate.

Louisiana cities depend on the property tax to sustain governmental services. The Assessors office offers you information regarding your homestead exemption millage rates ownerships property valuation and information for business owners as well. Online Property Tax System.

File with TaxProper in under two minutes only pay if you save. Most millage rates are approved when voted upon by voters of. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

The minimum combined 2022 sales tax rate for jefferson. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. The median property tax also known as real estate tax in Jefferson Parish is 75500 per year based on a median home value of 17510000 and a median effective property tax rate of.

Our office is open.

Jefferson Parish Residents Receiving Sticker Shock At Property Tax Bills

Hecht Group Pay Your Property Taxes In Jefferson Parish

Why Louisiana Property Owners Need To Pay Attention To An Ongoing Political Feud Louisiana Illuminator

Following Scrutiny Of Invalid Tax Exemptions For Two Folgers Properties Worth 40m Orleans Property Assessor Promises Comprehensive Review Of Property Tax Breaks The Lens

Jefferson Parish Louisiana Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Hire Us For Property Tax Abatement Reduction New Orleans

The St Tammany Parish Assessor S Office Proudly Serving St Tammany

Jefferson Parish Louisiana Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Payments Jefferson Parish Sheriff La Official Website

Jefferson Parish Assessor S Office Tax Estimate

The Best Neighborhoods In Jefferson Parish La By Home Value Bestneighborhood Org

Jefferson Parish Assessor S Office Tax Estimate

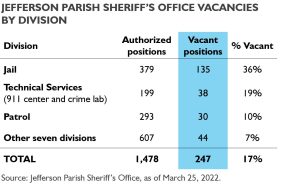

Bgr Analyzes Jefferson Parish Sheriff S Office Tax Proposal

Louisiana Property Taxes Taxproper

Jefferson Parish Consolidated Plan Executive Summary

Jefferson Parish Louisiana Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Home Ownership Matters Jefferson Parish Voters Agree To Raise Property Taxes To Increase Teacher Wages Improve Schools